Today’s employees want to see more than medical, vision, and dental in their benefits offerings. Does your benefits administration technology help you make that happen?

Many of you are gearing up for annual enrollment and we don’t have to tell you that this is prime time for getting eyes on your benefits. The right plan choices can directly impact an employee’s health, financial security, and overall well-being. Yet for many, navigating benefits enrollment feels overwhelming—filled with jargon, deadlines, and tough decisions.

That’s why we’ve turned insights from over 740,000 employee surveys into action to create an even more human-centered benefits experience.

While benefits literacy is still a challenge for 86% of employees, it doesn’t have to be a barrier to decision-making: 84% of employees rate their enrollment experience through Benefitsolver as “great” or “excellent” and 79% say they’re “confident” in their enrollment decisions.

This year, Businessolver has dug into improving the employee benefits experience, rolling out key upgrades ahead of 2026 enrollment, to support our clients with right-fit steerage and their employees with a better enrollment experience.

Read more about the upgrades here

Benefits administration is complex and multi-faceted—from finding the right options to offer to balancing in costs to making sure employees understand what’s offered—there’s a lot at stake!

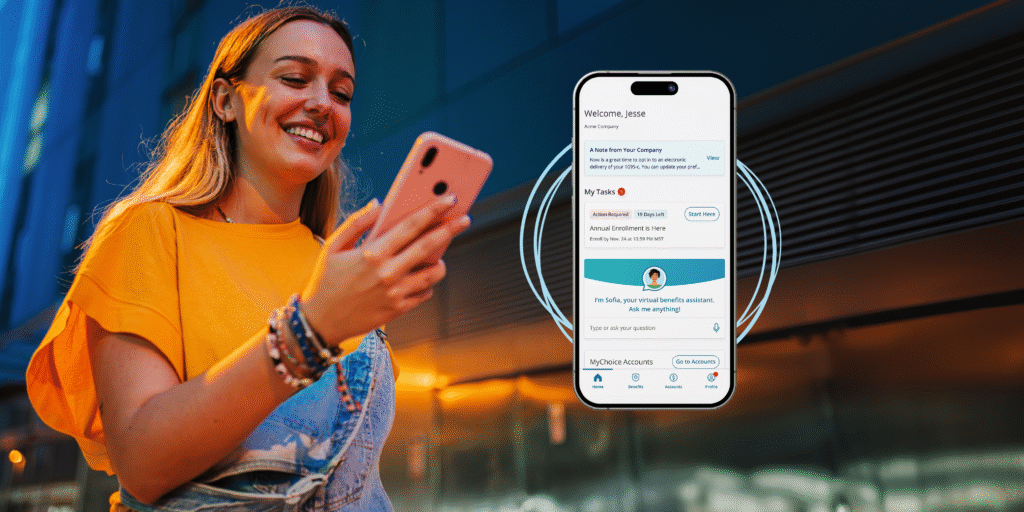

Having the right technology in place can help with both gathering insights and delivering a great experience. But not all benefits technology is created equal. Employees don’t just want technology—they want clarity, personalization, and guidance they can trust.

Our 2025 post-enrollment survey revealed:

Complexity is the barrier—and personalization is critical to removing that barrier. By rethinking benefits administration through the lens of human-centered UX, we’re closing the gap between confusion and confidence.

Personalization isn’t just a “nice to have.” Data from our 2025 Benefits Insights report shows that employees who feel supported during enrollment stay more engaged after enrollment: 36% of employees log in 4+ times post-enrollment when the experience is personalized.

When the technology blends personalization with ease of use, employees feel more confident and less stressed at enrollment.

Each enhancement we deliver is designed to remove friction, reduce confusion, and deliver an experience that feels as personal as the decisions being made. That looks like:

As HR leaders prepare for 2026 enrollment, one thing is clear: the employee benefits experience is no longer just about transactions—it’s about trust. By listening to employees and designing experiences that prioritize clarity, ease, and empathy, we’re shaping a future where benefits administration is both smarter and more human.

Because employees shouldn’t need a degree in benefits to make the right choices—and with Benefitsolver, they don’t.