Benefits are complex and, for 86% of employees, overwhelming and confusing. Yet they’re also a crucial aspect of supporting wellbeing and our health.

Engaging employees with their benefits has been a challenge for HR teams since the dawn of insurance jargon. But your benefits strategy doesn’t have to be as mind-boggling as reading a summary plan description.

Employees will never be benefits experts—but they don’t need to be to enroll in the right coverage and options for them. Here’s how you can help drive more engagement at annual enrollment.

57% of employees enroll in some form of medical coverage. But medical likely only makes up a small slice of your entire total rewards program. Voluntary benefits are quickly rising in popularity for employees, especially Gen Z and Millennials.

Employees want benefits beyond medical and the annual enrollment window is one of your biggest opportunities to show employees what’s available to them.

Consider promoting these top-wanted benefits and being clear about which benefits employees must opt-into at enrollment:

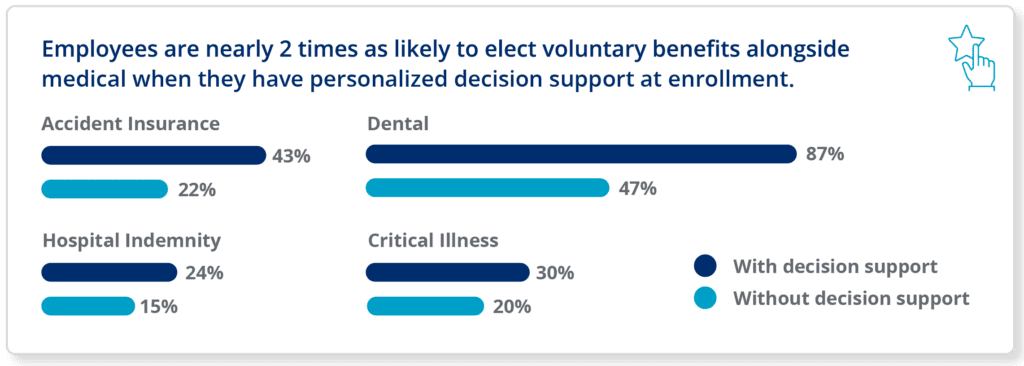

Employees are nearly twice as likely to elect voluntary benefits alongside medical coverage when the enrollment process is personalized.

Decision support can take the confusion out of benefits by helping guide employees through the enrollment process. Businessolver’s decision support tools ask questions to get to employees’ underlying needs and goals beyond just that pre-tax paycheck deduction.

By asking questions to understand an employee’s risk tolerance, financial situation, and health history, our decision support tool can serve up right-fit benefits with plain-language descriptions about why a benefit would be a good match for the employee.

Learn more about how decision support drives real results.

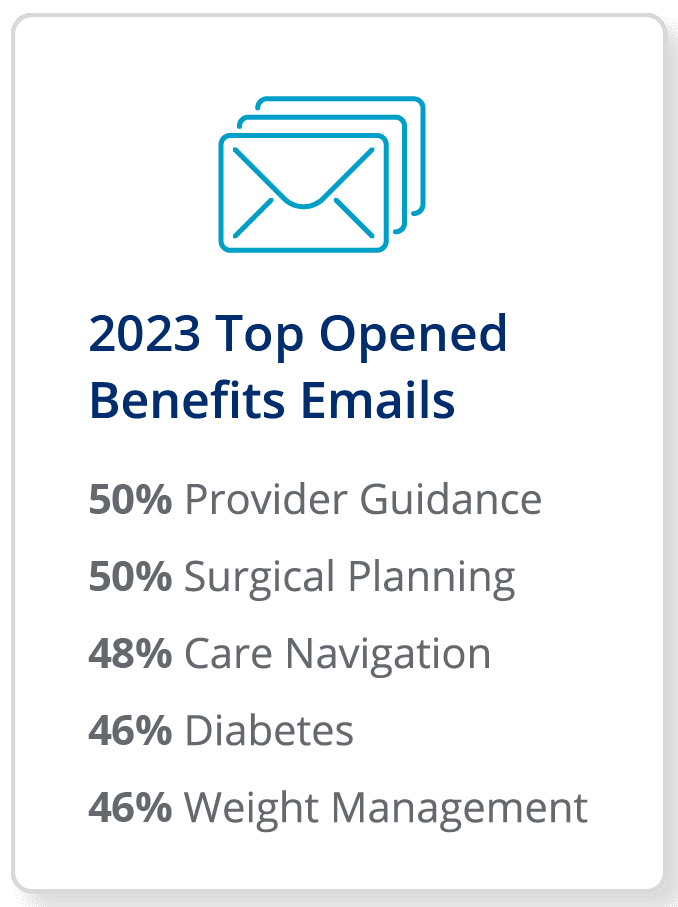

Employees tend to enroll in their benefits and then forget about them until they need them in a moment of stress. Consistent communications play a big role in grabbing employees’ attention before, during, and after enrollment about key benefits they have, or should consider enrolling in.

Even if you’re only running a passive enrollment, where employees don’t need to re-enroll to keep coverage, regularly communicating about your benefits can help keep employees engaged and informed. These email topics saw the most engagement among our clients’ employees last year:

Here are three tips for creating a great benefits communication plan:

Maximizing engagement at enrollment hinges on making the experience easy and accessible for your employees. There’s no one perfect solution for any organization, but our data proves that personalization and simplicity go a long way in helping employees get the right benefits at the right time, be that at enrollment or in a moment of need.

Driving 100% participation at enrollment requires a strategic focus on simplifying the process through personalized decision support tools, effectively promoting voluntary benefits, and maintaining consistent communication. By making benefits accessible and engaging you can help your employees to make informed choices that go beyond just medical coverage.